Case Results And Briefs

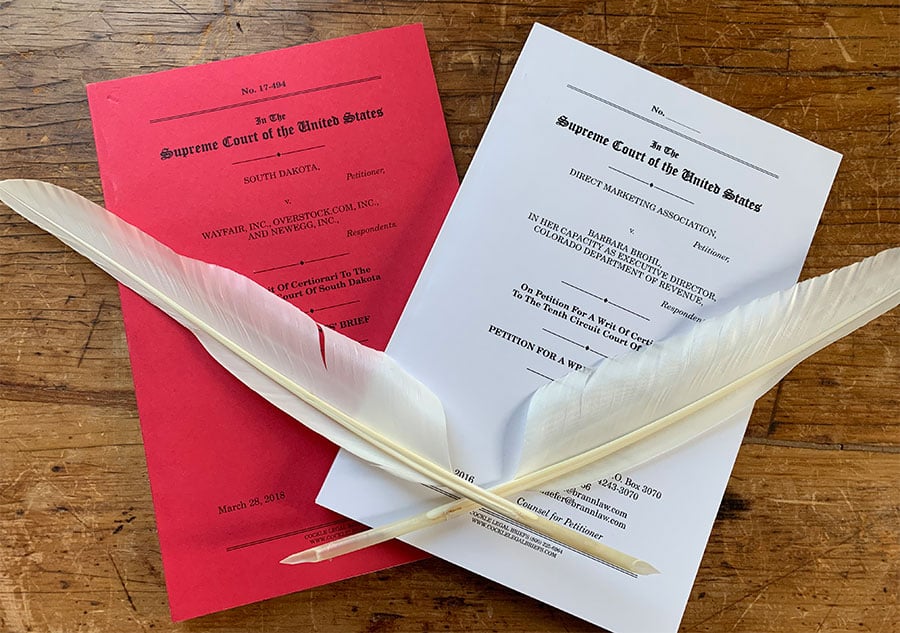

South Dakota v. Wayfair, Inc., 138 S.Ct. 2080 (2018) – Served as co-counsel for the Respondents in the landmark state tax decision, in which the Supreme Court, by a 5-4 decision, overruled Quill Corp. v. North Dakota, 504 U.S. 298 (1994). Although the decision was widely anticipated, the narrow margin was not., 2018

Direct Marketing Ass’n v. Brohl, 575 U.S. 1 (2015) — Served as co-counsel for the Petitioner in securing 9-0 decision of the United States Supreme Court, which reversed a decision of the 10th Circuit Court of Appeals concerning the proper scope of federal court jurisdiction under the Tax Injunction Act, 28 U.S.C. sec. 1341., 2015

Newegg, Inc. v. Alabama Department of Revenue, 2018 WL 3069238 (Ala. Tax Trib. 2018) — Represented retailer challenging application of Department if Revenue rule seeking to require sales/use tax collection by Internet seller with no physical presence in Alabama., 2018

American Catalog Mailers Ass’n v. Heffernan, 2017 WL 4542944 (Mass. Super. Ct. 2017) — Co-counsel trade association in successful challenge to Massachusetts Commissioner of Revenue Directive seeking to require sales/use tax collection by Internet retailers, invalidated by Superior Court for failure to follow Administrative Procedures Act., 2017

Crutchfield Corp. v. Testa, 2016-Ohio-7760 – Acted as co-counsel to an out-of-state retailer challenging the imposition of the Ohio Commercial Activity Tax in a widely-followed case. After a multi-year battle, the company ultimately lost the appeal 5-2., 2016

Performance Marketing Ass’n v. Hamer, 2013 Ill. 114496 — Served as co-counsel to the plaintiff in a successful challenge to the Illinois “click through nexus” law, invalidated by the Illinois Supreme Court as violative of the federal Internet Tax Freedom Act, 47 U.S.C. 151 (note)., 2013

State v. Thompson, 2008 Me. 166 — Successfully represented Pennsylvania resident before the Maine Supreme Judicial Court, securing a 5-2 decision overturning a default judgment for past due income taxes on the ground that the jurisdiction of Maine Revenue Services had not been established and was subject to collateral challenge., 2008

Matrix Group Ltd, Inc. v. Rawlings Sporting Goods Co., 477 F.3d 583 (8th Cir. 2007) — Served as co-counsel at trial (2006) and on appeal (2007) for the plaintiff, securing a jury verdict in excess of $8.5 million for breach of contract and tortious interference with business relations and successfully arguing on appeal for reinstatement of full measure of damages after reduction by federal district court., 2007